42nd District, June 5, 2013

Dear Friends and Neighbors,

Today is the 24th day of the 30-day special session. Budget negotiators have been meeting behind closed doors, but the only floor action to take place, in fact the only time the full House of Representatives has been in Olympia since the governor called the special session, was last Thursday.

The only bill we took action on was House Bill 2064, a bill that would provide another tax revenue stream. The bill would reinstate the estate tax, or death tax, on married couples’ assets. The reason this issue has come up is in response to another Washington State Supreme Court ruling. The bill passed 51-40, essentially along party lines with all Republicans and one Democrat voting against it.

The measure contains a retroactivity clause requiring 65 families, who have deceased family members, to pay about $138 million in taxes to the state Department of Revenue.

I strongly believe the bill is unconstitutional based on Article 1, Section 9 of the U.S. Constitution and Article 1, Section 23 of the Washington State Constitution, both of which prohibit ex post facto lawmaking. This piece of legislation reinstates the death tax and reaches beyond the grave to penalize the deceased person’s family, and adds insult to injury by engaging in the unconstitutional practice of retroactivity.

You may remember during the regular legislative session I introduced House Bill 1099, which would repeal this tax. That is the best solution for this issue. A farmer may be property rich, but cash poor – this tax hits these folks hard. It’s not a tax on the rich, it is a tax on deceased person’s family and remaining estate. Repealing the estate tax could also result in more family businesses growing in size, more jobs, and more tax revenues, instead of pushing businesses to close to comply with the estate tax law.

I also find it ironic that we were called back for one vote and two hours of deliberation in caucus and floor time at taxpayer expense, and the only bill we pass is one that taxes people so the state can have more of their money instead of allowing them to pass it along to their families.

The Seattle Times editorial has it right. Read Don’t just ‘fix’ the state estate tax, repeal it.

The Senate has a different version of the bill – Senate Bill 5939 – which contains the same retroactivity clause, but would make long-term reductions in the estate tax. The Washington State Wire article, Death and Taxes Create First Drama of Special Session – Senate Goes Eyeball-to-Eyeball With House Over Estate Tax, provides an overview of the issue.

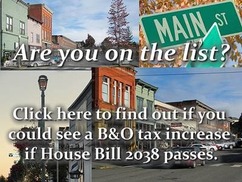

Taxing Main Street businesses

Skagit River Bridge

I also wanted to give you the latest update on the Skagit River Bridge collapse given the importance of this major transportation artery in our region. Currently, the timeline to have a temporary bridge in place is slated for mid-June and a permanent span in place by mid-September. Below are some links with information that are being updated as things progress.

- I-5 at Skagit River Bridge – this link is from the Washington State Department of Transportation (WSDOT) webpage. You should find updated information on the detour, traffic times, and the investigation.

- Traffic camera at I-5 at Skagit River Bridge – this will allow you to view the Skagit River Bridge site.

Sincerely,

Jason Overstreet

RSS Feed

RSS Feed